The market for solid oxide fuel cells (SOFCs) is set to reach US$6.8 billion by 2033.

เซลล์เชื้อเพลิงออกไซด์ของแข็ง 2023-2033: เทคโนโลยี การใช้งาน และการคาดการณ์ตลาด

เม็ดคาดการณ์ตลาด SOFC 10 ปีสำหรับหกพื้นที่การใช้งานที่สำคัญ, การวิเคราะห์พื้นที่การประยุกต์ใช้, การเปรียบเทียบของผู้เล่น, บวกการวิจัยตลาดของ SOFC ตำแหน่งและแนวโน้มเทคโนโลยีที่เกิดขึ้นใหม่.

Show All

Description

Contents, Table & Figures List

Pricing

Related Content

Solid Oxide Fuel Cell (SOFC) Market to Reach US$6.8 billion by 2033

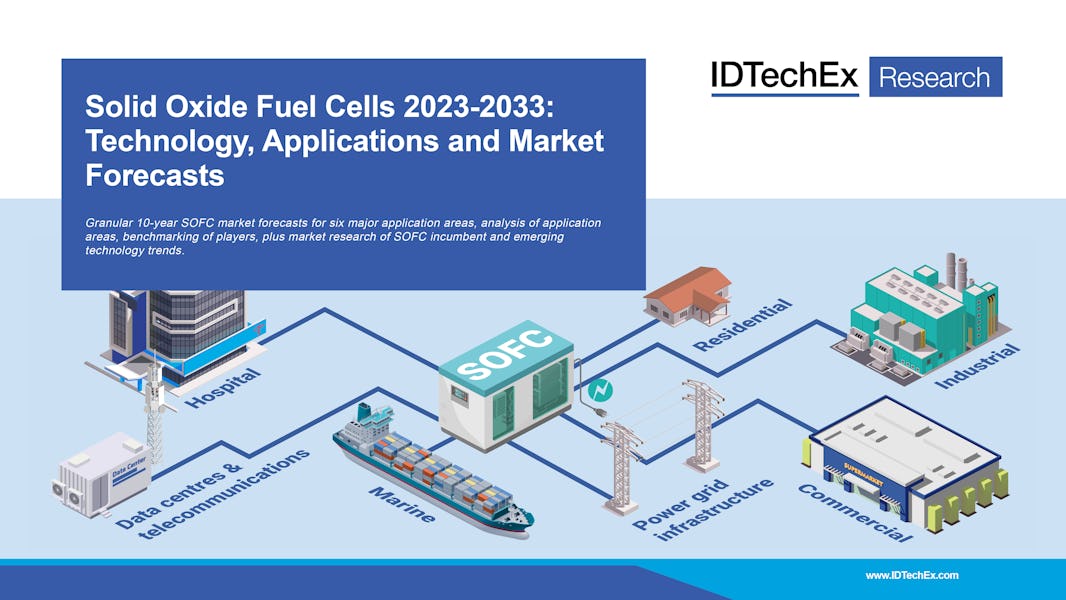

With the drive towards zero-emission power generation, fuel cells are continuing to generate noticeable interest, especially as part of the much hyped 'hydrogen economy'. The fuel flexibility of solid oxide fuel cells (SOFC) is of particular interest - capable of running on zero/low carbon emission fuels such as hydrogen, ammonia, and e-fuels, as well as light hydrocarbons. With applications ranging from utility-scale power generation to small off-grid residential units, will solid oxide fuel cells be the zero-emission power generation solution of tomorrow?

IDTechEx covers the energy and decarbonization sector comprehensively, detailing carbon capture technology, both electric and fuel cell vehicles, and hydrogen production. "Solid Oxide Fuel Cells 2023-2033: Technology, Applications, Players and Forecasts" includes granular 10-year forecasts segmented by application area for both megawatt demand and market valuation, while also detailing the price progression outlook for solid oxide fuel cells. It reveals that SOFCs are entering the growth phase, with market value set to grow to US$6.8 billion in 2033.

Historic annual installations (MW) for solid oxide fuel cells (2016-2022), and a breakdown of market share by application area for 2023.

A solid oxide fuel cell stack consists of hundreds of individual cells, featuring an electrolyte sandwiched between an anode and cathode, positioned between interconnects. A stack is integrated into a module in combination with the balance of plant. Due to high operating temperatures, one of the most critical issues to overcome for SOFCs is the matching of thermal expansion coefficient of neighboring components to limit stresses during operation. The typical material choice for the ceramic electrolyte is yttria-stabilized zirconia (YSZ) but ceria-based alternatives are emerging, enabling a reduction in operating temperature, and hence limiting degradation issues.

SOFCs are best suited to continuous, steady state operation due to extended ramp up times. The ability to operate on a fuel of natural gas allows the SOFC to be connected to gas grid for continuous supply of fuel. Continuous operation leads to a constant power output for SOFCs, which is particularly well suited for power generation for the grid, alongside commercial and industrial (C&I) applications. Combined heat and power (CHP) can be supplied to industrial/commercial spaces, while power alone is useful for applications such as data centres, critical operations (health care etc), and utility scale electricity generation. Each of the major application areas is covered in this IDTechEx report, detailing the suitability for SOFCs and comparison with competing solutions.

The landscape of players in the SOFC market is set to change dramatically over the coming decade. Bloom Energy are established as the current dominant player, with an installation base approaching 1 GW. However, competitors are emerging with both small companies and large multinationals entering the market through partnerships, licensing agreements or in-house R&D. IDTechEx provides an independent assessment of these emerging players including technology differentiators (including fuel flexibility) and targeted applications within the market.

This report provides critical solid oxide fuel cell (SOFC) market intelligence for technology and materials, an overview of six major application areas and includes an assessment of the key players in the SOFC market.

An overview of solid oxide fuel cell technologies and materials:

- Assessment of material trends for anode, cathode, electrolyte, and interconnect components.

- Overview of latest research and development for SOFC technology.

- Benchmarking with competing fuel cell technologies.

- Analysis and benchmarking of fuel choices for SOFC (methane, natural gas, methanol, biofuel, hydrogen, ammonia, e-fuel, etc).

A detailed account of the most critical application areas for solid oxide fuel cells:

- Extensive description of market sectors with growth opportunity for SOFC providing high-power stationary power (commercial, industrial, utilities, etc).

- Assessment of market sectors for SOFC providing low-power stationary power with a focus on combined heat and power (CHP) (residential, off-grid, etc).

- Overview of market sectors utilising SOFC for mobile applications (marine, auxiliary power units, unmanned aerial vehicles, etc).

An evaluation of players in the SOFC market:

- Historical assessment of major players including analysis of revenue (including split by service provided), profit/loss, employee numbers, installation base and IP activity.

- Coverage of emerging players - both small companies and large multinationals entering the market through partnerships, licensing agreements or in-house R&D.

Solid oxide fuel cell market forecasts:

- Granular 10-year SOFC market forecasts for megawatt demand (MW) segmented by six major application areas.

- Outlook for price progression of solid oxide fuel cells based on historic data, company interviews and stated targets.

- Granular 10-year forecast for SOFC market valuation ($USD) segmented by six major application areas.

"Solid Oxide Fuel Cells 2023-2033: Technology, Applications, Players and Forecasts" offers market forecasts and details of technology trends, key application areas and major players for the solid oxide fuel cell market.

| Report Metrics | Details |

|---|---|

| Historic Data | 2016 - 2022 |

| CAGR | The global market for solid oxide fuel cells is projected to reach US$6.8 billion in 2033, representing a CAGR of 25.1% when compared to the market in 2023. |

| Forecast Period | 2023 - 2033 |

| Forecast Units | Demand (MW), Value (USD$) |

Analyst access from IDTechEx

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you're addressing. This needs to be used within three months of purchasing the report.

Further information

If you have any questions about this report, please do not hesitate to contact our report team at research@IDTechEx.com or call one of our sales managers:

ASIA: +82 10 3896 6219

| 1. | EXECUTIVE SUMMARY AND CONCLUSIONS |

| 1.1. | Introduction to fuel cells |

| 1.2. | SOFC working principle |

| 1.3. | SOFC assembly and materials |

| 1.4. | Overview of key players |

| 1.5. | Why now? |

| 1.6. | Desire for emission-free fuels |

| 1.7. | Fuel choices for SOFCs |

| 1.8. | Normalized benchmarking of SOFC fuels |

| 1.9. | Commercial use of fuels in SOFCs |

| 1.10. | LCOE from solid oxide fuel cells |

| 1.11. | Main applications for SOFCs |

| 1.12. | SOFCs for C&I Applications |

| 1.13. | SOFCs for Utilities |

| 1.14. | SOFCs for Data & Telecommunications |

| 1.15. | SOFCs for Residential Applications |

| 1.16. | Latest research for SOFCs |

| 1.17. | SOFCs for marine applications |

| 1.18. | Solid Oxide Electrolyzer (SOEC) overview |

| 1.19. | SOFC demand (MW) by application 2020-2033 |

| 1.20. | Price progression ($/kW) for SOFCs |

| 1.21. | SOFC market value outlook by application 2023-2033 |

| 1.22. | Market share (MW) by application |

| 2. | MARKET FORECASTS |

| 2.1. | Long-term forecasting of technologies |

| 2.2. | Forecast methodology |

| 2.3. | Forecast assumptions |

| 2.4. | SOFC demand (MW) 2016-2033 |

| 2.5. | SOFC demand (MW) by application 2020-2033 |

| 2.6. | Price progression ($/kW) for SOFCs |

| 2.7. | SOFC market value outlook 2023-2033 |

| 2.8. | SOFC market value outlook by application 2023-2033 |

| 3. | INTRODUCTION |

| 3.1.1. | Introduction to fuel cells |

| 3.1.2. | What is a fuel cell? |

| 3.1.3. | SOFC working principle |

| 3.1.4. | Alternative fuel cell technologies: PEMFC |

| 3.1.5. | Alternative fuel cell technologies |

| 3.1.6. | Comparison of fuel cell technologies |

| 3.1.7. | SOFC assembly and materials |

| 3.1.8. | Electrolyte |

| 3.1.9. | Anode |

| 3.1.10. | Cathode |

| 3.1.11. | Interconnect for planar SOFCs |

| 3.1.12. | Tubular SOFC |

| 3.1.13. | Polarization losses |

| 3.1.14. | SOFC variations |

| 3.1.15. | Combined heat & power (CHP) |

| 3.1.16. | Government targets |

| 3.1.17. | EU 'Fit for 55' |

| 3.1.18. | Overview of players in the SOFC market - USA |

| 3.1.19. | Overview of players in the SOFC market - Europe |

| 3.1.20. | Overview of players in the SOFC market - China |

| 3.1.21. | Overview of players in the SOFC market - APAC |

| 3.2. | Latest SOFC Research & Developments |

| 3.2.1. | AVL enable development of SOFC systems |

| 3.2.2. | Low temperature SOFCs |

| 3.2.3. | Kyocera's cylinder-plate fuel electrode supports |

| 3.2.4. | Automated operation learning system |

| 3.2.5. | 3D printing for SOFCs |

| 3.2.6. | Power generation from unused biomass resources |

| 3.2.7. | AMON Project |

| 4. | FUELS FOR SOFCS |

| 4.1. | Desire for emission-free fuels |

| 4.2. | Low carbon fuels for fuel cells |

| 4.3. | Classification of fuels by carbon emissions |

| 4.4. | Natural gas for SOFCs |

| 4.5. | Liquified natural gas (LNG) |

| 4.6. | Hydrogen economy |

| 4.7. | Colours of hydrogen |

| 4.8. | Hydrogen for SOFCs |

| 4.9. | Ammonia for SOFCs |

| 4.10. | Ammonia production - Haber Bosch |

| 4.11. | Ammonia production - Nitrogen electrolyser |

| 4.12. | Overview of e-fuels |

| 4.13. | Benchmarking volumetric energy density of SOFC fuels |

| 4.14. | Benchmarking carbon emissions of SOFC fuels |

| 4.15. | Normalized benchmarking of SOFC fuels |

| 4.16. | Commercial use of fuels in SOFCs |

| 5. | COMMERCIAL & INDUSTRIAL APPLICATIONS FOR SOFCS |

| 5.1. | SOFC for C&I applications |

| 5.2. | Worldwide energy demand growth |

| 5.3. | Data centres |

| 5.4. | Utilities - LCOE |

| 5.5. | LCOE from solid oxide fuel cells |

| 5.6. | Utilities case study: South Korea |

| 5.7. | Commercial case study: Walmart |

| 5.8. | Data case study: AT&T |

| 5.9. | Utilities case study 2: Mitsubishi Power |

| 5.10. | Integrated gasification fuel cell |

| 5.11. | Integrated gasification fuel cell (2) |

| 6. | MAIN PLAYERS FOR C&I APPLICATIONS |

| 6.1. | Bloom Energy |

| 6.1.1. | Bloom Energy - Overview |

| 6.1.2. | Bloom Energy - Technology |

| 6.1.3. | Bloom Energy - Installation Base |

| 6.1.4. | Bloom Energy - Financials |

| 6.1.5. | Bloom Energy - Financials Analysis |

| 6.1.6. | Bloom Energy - Example customers |

| 6.1.7. | Bloom Energy - Example customers (2) |

| 6.1.8. | Bloom-SK Fuel Cell |

| 6.1.9. | Bloom Energy - SWOT |

| 6.2. | Ceres Power & Partners |

| 6.2.1. | Ceres Power - Overview |

| 6.2.2. | Ceres Power - Technology |

| 6.2.3. | Ceres Power - Financials |

| 6.2.4. | Ceres Power - SWOT |

| 6.2.5. | Ceres Power & Partners |

| 6.2.6. | Ceres Power & Bosch/Weichai |

| 6.2.7. | Ceres Power & Miura |

| 6.2.8. | Ceres Power & Doosan |

| 6.2.9. | Ceres Power & BOSAL |

| 6.3. | Other Notable Players |

| 6.3.1. | Cummins - Overview |

| 6.3.2. | Cummins - Applications |

| 6.3.3. | Cummins - SWOT |

| 6.3.4. | Mitsubishi Power - Overview |

| 6.3.5. | Mitsubishi Power - Technology |

| 6.3.6. | Mitsubishi Power - SWOT |

| 6.3.7. | FuelCell Energy - Overview |

| 6.3.8. | FuelCell Energy - IGFC |

| 6.3.9. | FuelCell Energy - SWOT |

| 7. | RESIDENTIAL APPLICATIONS FOR SOFCS |

| 7.1.1. | SOFC for residential applications |

| 7.1.2. | Incorporation with solar power |

| 7.1.3. | Modularity of systems |

| 7.1.4. | Feed-in tariffs (FiT) |

| 7.1.5. | Comparison with residential batteries |

| 7.1.6. | Outlook for residential SOFCs |

| 7.2. | Players offering residential and off-grid SOFCs |

| 7.2.1. | OxEon Energy |

| 7.2.2. | Upstart Power |

| 7.2.3. | Aris Renewable Energy |

| 7.2.4. | Edge autonomy |

| 7.2.5. | Osaka Gas |

| 7.2.6. | Sunfire fuel cells |

| 7.2.7. | Comparison of residential SOFCs |

| 8. | MARINE APPLICATIONS FOR SOFCS |

| 8.1. | Introduction to SOFCs for marine applications |

| 8.2. | Overview of policy drivers |

| 8.3. | The International Maritime Organization (IMO) |

| 8.4. | Emission control areas |

| 8.5. | Sulphur and nitrous oxide emissions |

| 8.6. | Traditional solutions: Scrubbers & speed reduction |

| 8.7. | Shifting emission policy focus |

| 8.8. | Marine CO2 emissions and targets |

| 8.9. | Reducing greenhouse gases: EEXI & CII |

| 8.10. | EU-specific policy |

| 8.11. | SOFC for marine |

| 8.12. | Fuel cell supplier market share 2019-2024 |

| 8.13. | Fuel cell deliveries by vessel type 2019-2024 |

| 8.14. | Average power of FC deliveries 2019-2024 |

| 8.15. | Solid oxide fuel cell players |

| 8.16. | Alma Clean Power |

| 8.17. | Bloom Energy |

| 8.18. | Ceres / Doosan |

| 8.19. | SOFC Barriers & future commentary |

| 8.20. | Comparison of commercial marine fuel cells |

| 9. | SOFC POWERED VEHICLES |

| 9.1. | Volkswagen |

| 9.2. | Nissan |

| 9.3. | Unmanned vehicles |

| 9.4. | Auxiliary power units |

| 9.5. | Outlook for SOFC powered vehicles |

| 10. | SOLID OXIDE ELECTROLYSIS |

| 10.1. | Electrolyzer systems overview |

| 10.2. | Electrolyzer systems comparison - Operating parameters |

| 10.3. | Pros and cons of electrolyzer technologies |

| 10.4. | SOEL Overview |

| 10.5. | SOEL Systems: A substitute for AWE? |

| 10.6. | Solid Oxide Electrolyzer: Introduction |

| 10.7. | Solid Oxide Electrolyzer efficiency |

| 10.8. | Reversible SOFC |

| 10.9. | SOEL Electrolyzers systems: Materials, specifics |

| 10.10. | SOEL Market |

| 10.11. | SOEL Supply chain |

| 10.12. | New high-temperature electrolysis technology |

| 11. | COMPANY PROFILES |

| 11.1. | Alma Clean Power |

| 11.2. | AVL |

| 11.3. | Bloom Energy |

| 11.4. | Ceres Power |

| 11.5. | Cummins |

| 11.6. | FuelCell Energy |

| 11.7. | OxEon Energy |

| 11.8. | SolydEra (SOLIDpower) |

| 11.9. | Edge Autonomy |

| 11.10. | Elcogen |

| 11.11. | HyAxiom |

| 11.12. | Osaka Gas |

| 11.13. | Redox Power Systems |

| 11.14. | Sunfire |

| 11.15. | Upstart Power |

Ordering Information

เซลล์เชื้อเพลิงออกไซด์ของแข็ง 2023-2033: เทคโนโลยี การใช้งาน และการคาดการณ์ตลาด

£€$¥元

Electronic (1-5 users)

£5,650.00

Electronic (6-10 users)

£8,050.00

Electronic and 1 Hardcopy (1-5 users)

£6,450.00

Electronic and 1 Hardcopy (6-10 users)

£8,850.00

Electronic (1-5 users)

€6,400.00

Electronic (6-10 users)

€9,100.00

Electronic and 1 Hardcopy (1-5 users)

€7,310.00

Electronic and 1 Hardcopy (6-10 users)

€10,010.00

Electronic (1-5 users)

$7,000.00

Electronic (6-10 users)

$10,000.00

Electronic and 1 Hardcopy (1-5 users)

$7,975.00

Electronic and 1 Hardcopy (6-10 users)

$10,975.00

Electronic (1-5 users)

¥900,000

Electronic (6-10 users)

¥1,260,000

Electronic and 1 Hardcopy (1-5 users)

¥1,020,000

Electronic and 1 Hardcopy (6-10 users)

¥1,380,000

Electronic (1-5 users)

元50,000.00

Electronic (6-10 users)

元72,000.00

Electronic and 1 Hardcopy (1-5 users)

元58,000.00

Electronic and 1 Hardcopy (6-10 users)

元80,000.00

Click here to enquire about additional licenses.

If you are a reseller/distributor please contact us before ordering.

お問合せ、見積および請求書が必要な方はm.murakoshi@idtechex.com までご連絡ください。

Report Statistics

| Slides | 187 |

|---|---|

| Companies | 15 |

| Forecasts to | 2033 |

| ISBN | 9781915514646 |

Preview Content

|

|

|

|

|

|